Wilhelmshaven energy hub attracts industry

(energate) Wilhelmshaven wants to become more than just a transhipment point for LNG, ammonia, hydrogen and CO2. "Apart from quite a lot of work, little has happened in our town, with regard to jobs and trade tax," criticised Lord Mayor Carsten Feist at a press event organised by the Initiative Zukunft Gas.

Wilhelmshaven (energate) - Wilhelmshaven wants to become more than just a transhipment point for LNG, ammonia, hydrogen and CO2. "Apart from quite a lot of work, little has happened in our town, with regard to jobs and trade tax," criticised Lord Mayor Carsten Feist at a press event organised by the Initiative Zukunft Gas. He himself was surprised on 27 February by the Chancellor's announcement that Wilhelmshaven would become a berth for one of the state-leased special LNG ships (FSRU) to get Germany through the winter with energy security. Just ten months later, the new terminal went into operation in the port city in Lower Saxony. "We delivered," says Feist, who hopes in the medium term to double the current trade tax of 30 million euros.

An LNG tanker now lands once a week, with a precious cargo worth tens of millions on board. At the FSRU, however, only 35 employees from different countries work in shifts 24/7 to unload the tankers within 20 hours and then feed the regasified quantities into the natural gas grid.

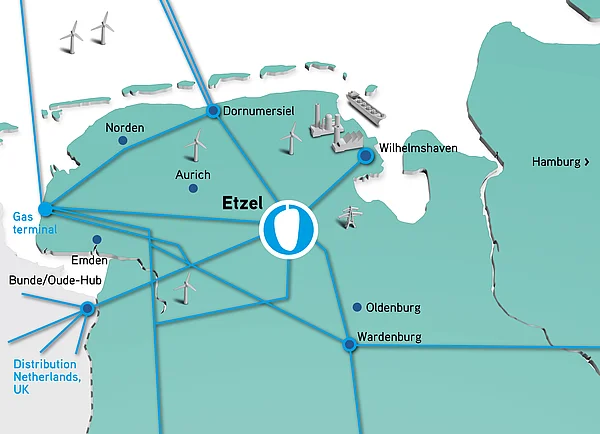

Besides LNG, which the mayor wants to accept "only as long as necessary", there are big plans to upgrade Wilhelmshaven as an energy hub and industrial location. Feist expects this to create 1,500 to 2,000 new jobs. The economic development agency counts a total of 30 projects, eight of which are planning stage, according to the Wilhelmshaven Economic Development Agency. According to their calculations, the region could cover 40 to 60 per cent of Germany's hydrogen demand in 2031.

Ammonia terminal and CO2 transport pipeline in the planning stage

The state-owned company Uniper, for example, is planning to build an import terminal for ammonia and a 1 GW electrolysis plant. Wintershall wants to produce 5.6 TWh of blue hydrogen from Norwegian natural gas from 2028 and, conversely, transport millions of tonnes of CO2, first by ship and later with a new CO2 pipeline. The region, however, hopes for more. "We have nothing to gain from just sending the hydrogen through the pipeline," explained the region.

pipeline," explained Uwe Oppitz from the Wilhelmshaven Economic Development Agency [Energy Hub - Port of Wilhelmshaven] at the on-site meeting. The rather structurally weak region wants to catch up with Bavaria and Baden-Württemberg, which used to attract industrial companies with cheap nuclear power. The location wants to score points with cheap offshore electricity, hydrogen, good infrastructure and CCS, i.e. the possibility of transporting unavoidable emissions and storing them in Denmark or Norway. The paper mill in Varel, Lower Saxony, is a showcase project that wants to decarbonise more quickly with the help of Wilhelmshaven. Others are to follow, even though Oppitz is well aware that Covestro will not "dismantle its chemical production in Leverkusen with a spanner and rebuild it here".

Uniper: holding on to industry

Gundolf Schweppe, as CCO Sales responsible for industrial customer sales at Uniper, certainly sees opportunities here - also for the company's own well-connected coal-fired power plant sites. He talks about green ammonia with Covestro, BASF and Stickstoffwerke Piesteritz, among others.

"All of them are now getting pressure from their supervisory boards," he said in Wilhelmshaven. With the Uniper could use the new terminal to meet Germany's entire ammonia demand of 3 million tonnes.

and thus replace 25 TWh of natural gas. Unlike hydrogen - "without much conversion effort, with the same trucks and freight wagons". In his eyes, however, the industry's demand is so great that not only all the floating LNG terminals planned in Germany have their justification, but also Tree Energy Solutions' synthetic methane terminal, also planned in Wilhelmshaven. "The high price volatility comes precisely from the fact that there is not enough capacity," says the Uniper board member. Germany should not rest on its laurels from the mild winter of 2022/2023 and the currently full storage facilities. The great art now is to keep the industry going until 2027, "when everything really gets going here in Wilhelmshaven". In Dormagen, the Covestro plant is currently at a standstill and BASF has also pulled the emergency brake on one site due to energy prices.

Source: https://www.energate.de